Import Diversification and Trade Resilience (with Bernhard Dalheimer and Gabriel Rosero)

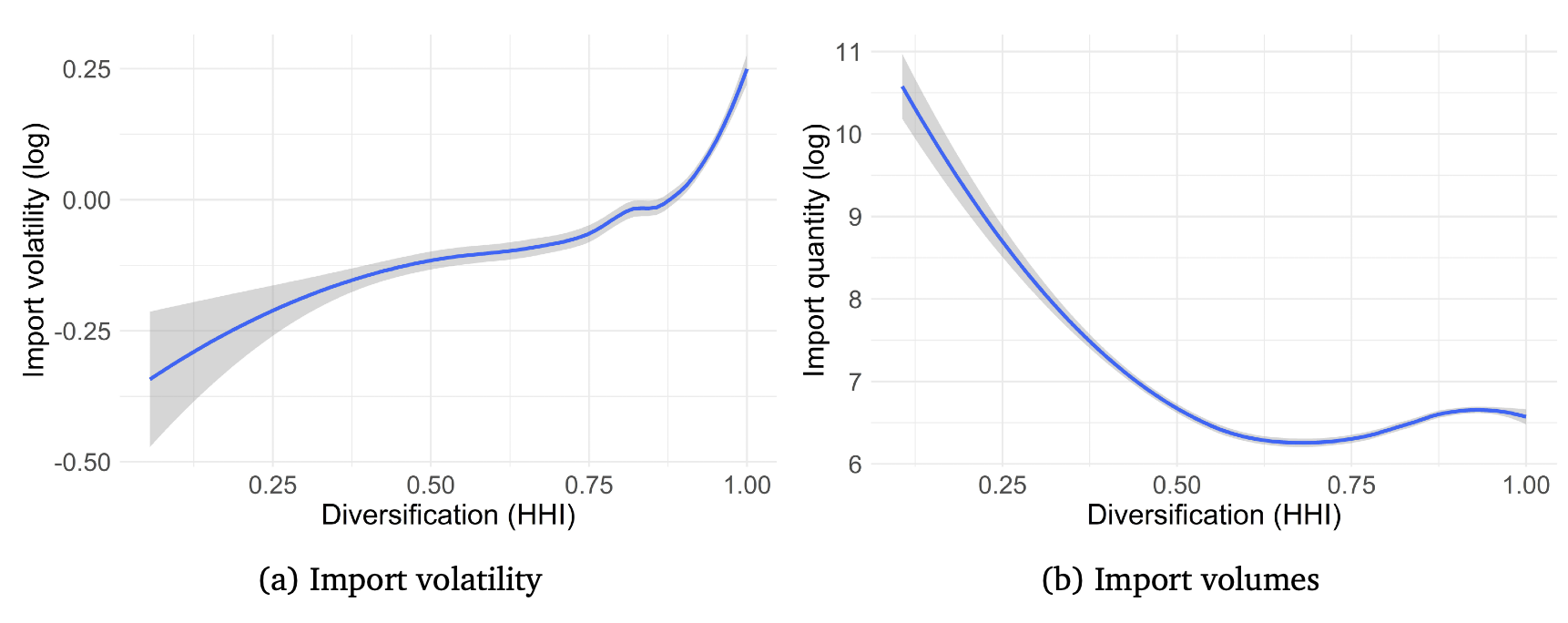

We examine how diversification in import sourcing moderates resilience to upstream shocks, focusing on two specific but recurrent risks: pandemics and geopolitical conflicts. Using annual data on global trade and weekly data from Swiss importing firms, we assess how diversification before an upstream shock affect the growth rate of imports at the product level. Guided by a theoretical framework that introduces risk aversion into global sourcing, we estimate a reduced-form gravity model and report two sets of empirical findings. First, we establish that both shocks significantly reduce the growth rate of imports. Second, using various diversification measures defined at the importer-product level as proxies for risk aversion, we show that more diversified firms, reflecting greater risk aversion, exhibit greater resilience to these disruptions. Specifically, importers with higher pre-shock source diversity show lower declines in import growth during a shock. That the results align across macro and micro levels enhances the external validity of our findings and positions diversification as a scalable resilience strategy.

Figure: Supply chain shocks, diversification and import growth

Food Production Shocks and Agricultural Supply Elasticities in Sub-Saharan Africa (with Bernhard Dalheimer)

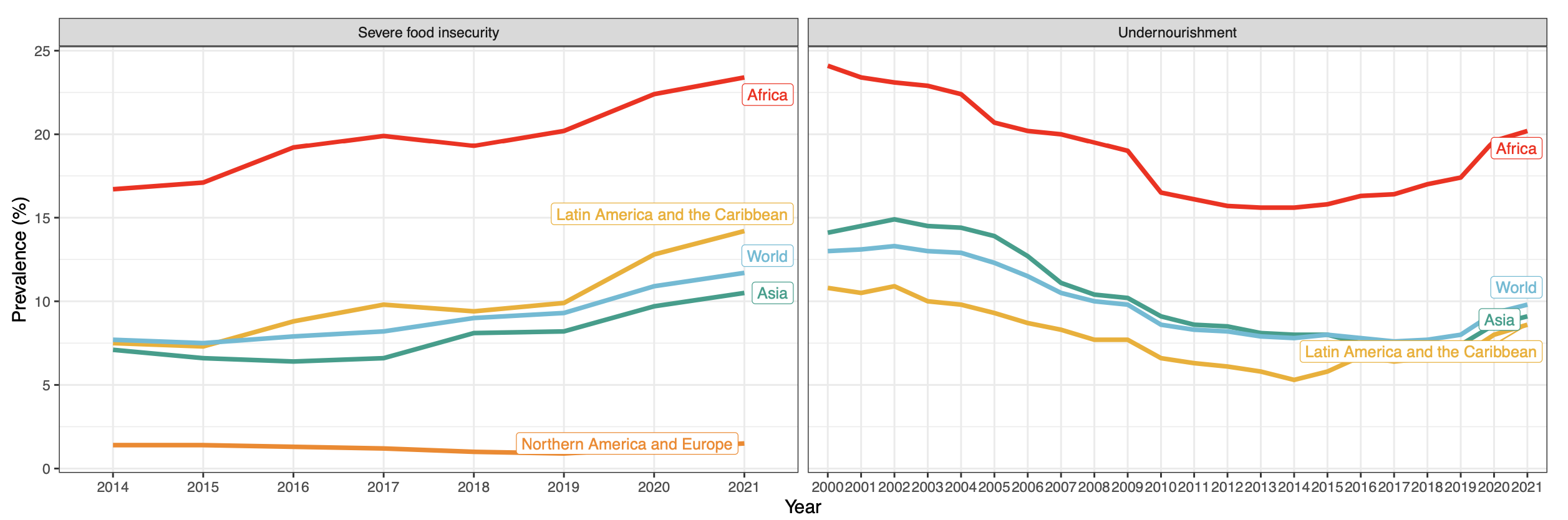

This paper estimates the food supply elasticity in SSA. Building up on commodity storage theory, we empirically estimate food supply functions for SSA. Our identifications strategy relies on exogenous weather shocks as instruments. This approach further allows to quantify the exposure of SSA food markets to weather events. We use data from FAO, USDA, WFP and public climate data to model 3 commodities in 173 food markets in 34 countries in SSA. Results suggest that (i) food supply in SSA is more elastic than global food supply, and (ii) prices are much more subject to exogenous weather events than global prices are. Moreover, we find substantial heterogeneity of food market responses to weather shocks and price developments by crops. These results are in line with commodity storage theory as in absence of opportunities to build inventories, producers will not shift supplies across time periods. Promoting storage activity — also through imports — and investing in storage facility can smoothen consumption, stabilize markets and reduce long term production uncertainty in the region.

Figure: Incidence of food insecurity in Africa

Check out the working paper and slides

Global wheat price shocks and firm-level export price setting (with Daniele Curzi and Daniele Valenti)

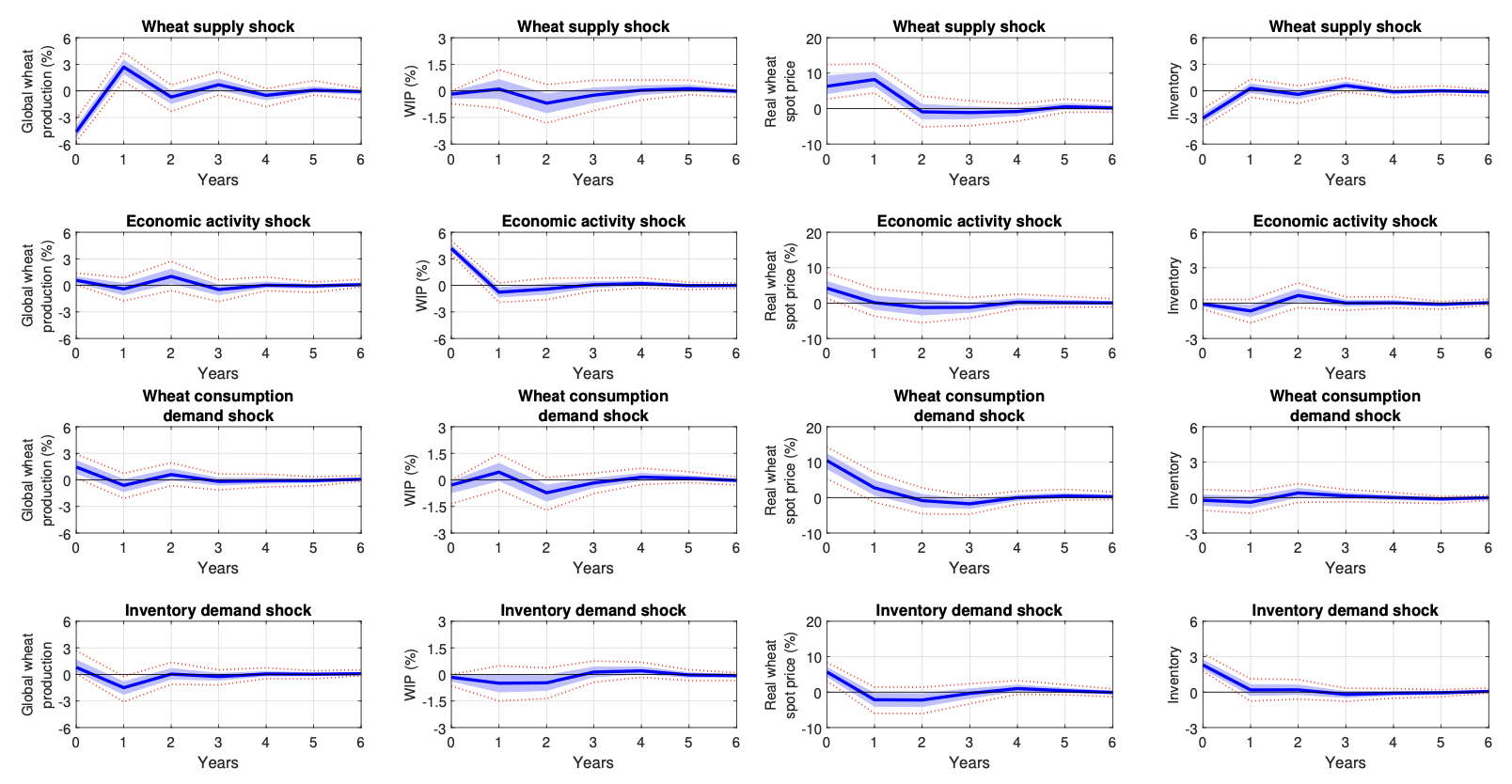

We study how global wheat market shocks transmit to export prices of pasta and related wheat based products. We first estimate a Bayesian structural vector autoregression for the world wheat market using annual data from 1970 to 2022 on production, inventories, real wheat prices, and global economic activity. The model yields structural shocks that capture unexpected shifts in wheat supply, global activity, consumption demand, and inventory demand. We then link these shocks to Italian customs microdata on export unit values by firm, product, and destination from 2004 to 2022, controlling for firm, product, destination, and market conditions. We find economically meaningful pass through from global wheat price movements driven by demand and inventory forces, while supply shocks have weaker and slower effects. Price responses are asymmetric, with larger adjustments following positive shocks than negative shocks. Heterogeneity analyses suggest smaller pass through for firms that import wheat directly, consistent with input sourcing and risk management dampening exposure. The results highlight the role of global commodity shocks in food price formation and the importance of firm level strategies in buffering international price volatility.

Figure: Impulse response of endogenous variables to structural shocks

Check out a blog post

Trade barriers or catalysts? Non-tariff measures and firm-level trade margins (with Abraham Lartey and Woubet Kassa)

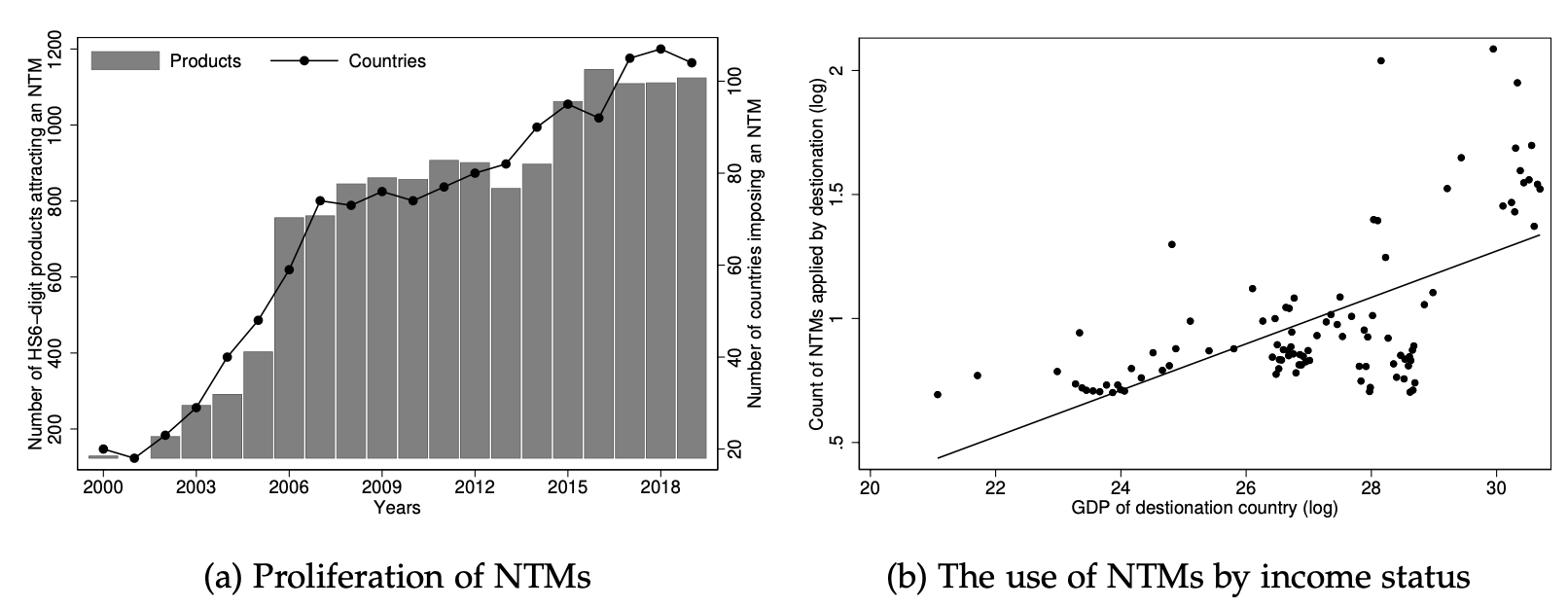

We empirically examine how standards and technical regulations affect export margins in selected African countries at the firm level. Our approach involves combining detailed customs transaction data at the firm-product level with bilateral information on non-tariff measures within a gravity model of trade framework. We find no impact of standards and technical regulations on the extensive margin of firm-level trade. However, we find that they do diminish trade at the intensive margin in both agricultural and manufacturing sectors. Small firms are more affected at the intensive margin compared to medium and large firms, and similarly, consumable goods are more affected compared to intermediate goods. Moreover, in the manufacturing sector, firms with initially higher product quality experience a reversal of the trade-reducing effect, whereas in the agricultural sector, this effect is less pronounced for their counterparts. Our results also suggest that African exporting firms face equivalent impacts in both regional and global markets.

Figure: The proliferation of NTMs over time and development level of destinations

Check out the working paper